The San Bruno Park School District (SBPSD) educates and empowers all students to thrive academically, socially and emotionally and be contributing members of society. The District strives to engage and inspire our students to be productive critical thinkers who embrace diversity, curiosity, and innovation throughout their lives.

PARCEL TAX UPDATES

The San Bruno Park Elementary School District (SBPSD) in California approved a parcel tax on November 5, 2024:

Measure X: The parcel tax is $68 per parcel for eight years, generating $730,000 annually. The funds will be used for:

Science, technology, engineering, art, and math programs

Updating textbooks and instructional materials

Attracting and retaining qualified teachers and counselors

Approval: The measure passed with a majority vote of 82.6%.

Senior Exemptions for Special School Parcel Taxes

Senior Homeowners (65+) must contact the school district directly to request an application and sign up for the exemption. A parcel tax exemption is available to:

Property owners who are 65 years of age or older on July 1, 2025.

Property owners' main residence is the city of San Bruno

Frequently Asked Questions

How are San Bruno Park (SBPSD) schools performing? The San Bruno Park School District (SBPSD) educates and empowers all students to thrive academically, socially and emotionally and be contributing members of society. The District strives to engage and inspire our students to be productive critical thinkers who embrace diversity, curiosity and innovation throughout their lives.

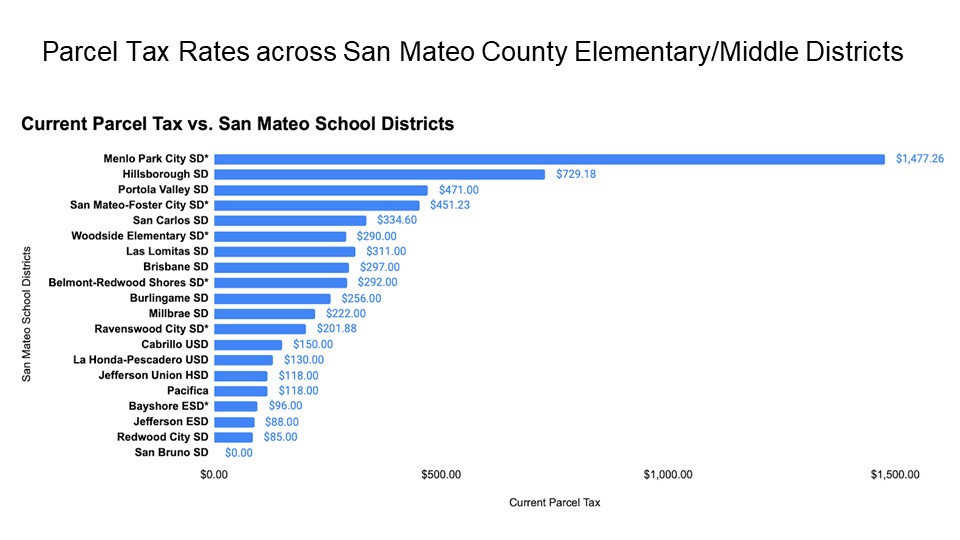

What challenges face our local schools? The State of California only provides enough money for a basic education and providing a quality education starts in the classroom. Of the 23 school districts in San Mateo, San Bruno Park is the only elementary school district that does not have a dedicated source of local funding for our schools.

How exactly would a potential measure help support our local schools and students? To provide a quality education, the Governing Board is considering establishing a parcel tax for $68 annually for 8 years. If approved by voters, funding from this measure could be used to:

Provide quality programs in science, technology, engineering and math

Attract and retain qualified teachers

Keep textbooks and instructional materials up-to-date

What fiscal accountability provisions will be included in a potential measure? A potential measure would require fiscal accountability requirements, ncluding:

All funds would be controlled locally for SBPSD schools only and could not be taken away by the State

No funds would be used to pay for administrators’ salaries

Independent citizens’ oversight and mandatory annual audits would be required

Homeowners who are senior citizens or individuals receiving supplemental disability insurance would be eligible for an exemption

Does the State provide funding to help support our schools? Nationally, California ranks among the lowest in funding provided to public schools. A dedicated local funding source for our schools would ensure that students have the same opportunities to learn, succeed as others in the County.

I don’t have children attending local schools. How does this impact me? Even if you do not have school-age children, supporting quality education in our local schools can improve the quality of life in our community and protect the value of our homes.

Would senior citizen homeowners be exempt from the cost? Yes. Senior citizens homeowners would be eligible for an exemption from the cost of the measure.

Would all funds benefit our neighborhood schools only? All funds from a potential measure would benefit local schools only. No funds could be taken by the State or used for other purposes.

How can I share my thoughts? As SBPSD explores local funding options, we welcome your input. For more information or to ask questions, please contact mduffy@sbpsd.k12.ca.us.

Fiscal Accountability and Local Control Required

All funds will be controlled locally for SBPSD schools only and could not be taken away by the State

No funds will be used to pay for administrators’ salaries

Independent citizens’ oversight and mandatory annual audits are required

Senior citizen homeowners would be eligible for an exemption from the cost